Gold and the Dollar

Gold is generally quoted in US dollars per ounce of gold; so any fluctuations in the strength of the dollar are likely to be reflected in the dollar price of gold: when the dollar falls the gold price rises........ and when the dollar rises gold falls. The relationship is not exactly inverse, however, and there are times when both gold and the dollar rise or fall simultaneously.

Divergences

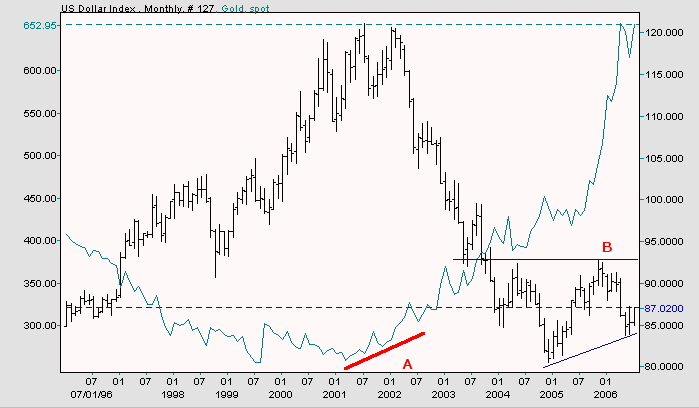

For want of a better term we call these periods, when the normal inverse relationship breaks down, divergences. On the chart below the US Dollar Index rises when gold falls, and vice versa, except for divergences at [A] and [B].

The divergence at [A] occurs when a rising gold price gives advance warning of a decline in the dollar.

Data Source: Netdania

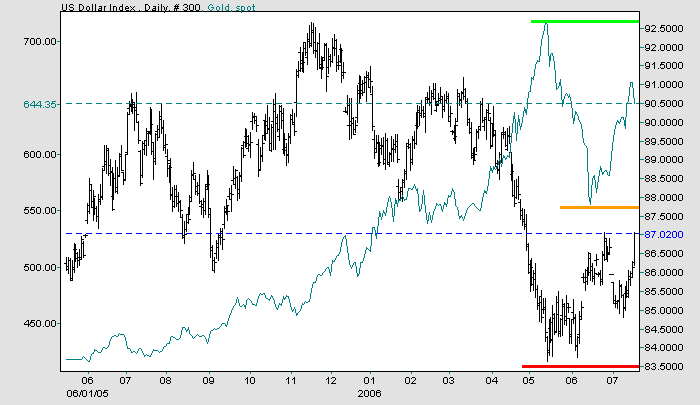

At [B] the index consolidates while gold continues to rise. The consolidation may be the start of an inverted head and shoulders or ascending triangle, but either pattern would only be confirmed if the index breaks through resistance at 92.5.

|

The US Dollar index reflects the value of the US Dollar against the currencies of its major trading partners. The heaviest weighting is the Euro which accounts for 57.6% of the index total.

|

If gold falls below its recent support level of $550 per ounce, then the US Dollar Index is likely to reach 92.5. If not, and gold rises above its recent high of $730, expect the US Dollar Index to show weakness and fall through its recent support level of 83.5.

Data Source: Netdania

The Fed holds the only wild card: further interest rate rises would support the dollar and possibly interfere with the normal inverse relationship.

Gold was not selected arbitrarily by governments to be the monetary standard.Gold had developed for many centuries on the free market as the best money;

as the commodity providing the most stable and desirable monetary medium.

~ Murray N. Rothbard

Deficit spending is simply a scheme for the 'hidden' confiscation of wealth.

Gold stands in the way of this insidious process.

It stands as a protector of property rights.

~ Alan Greenspan

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.