Safezone Stops

Traders adjust their stops over time in the direction of the trend in order to lock in profits. As an alternative to Moving Average and Average True Range trailing stop systems, Alexander Elder introduces SafeZone Stops in Come Into My Trading Room (2002).

Dr Elder designed SafeZone to eliminate the "noise" component of a trend and hopefully avoid having stops shaken out by that noise. He uses a 22-day Exponential Moving Average to define the trend, but I prefer a longer (63-day) exponential moving average. Elder then calculates directional movement in a similar fashion to Welles Wilder's Directional Movement System and applies a multiple of between 2 and 3 to determine the trailing stop.

Safezone Trading Signals

Safezone stops are primarily used to time exits from a trending market. Use the exponential moving average to determine the trend and select the Safezone long or short option.

- Exit long positions when price crosses below the Safezone stop.

- Exit short positions when price crosses above the Safezone stop.

Safezone cannot be used to signal entries as with some stop-and-reverse systems.

Example

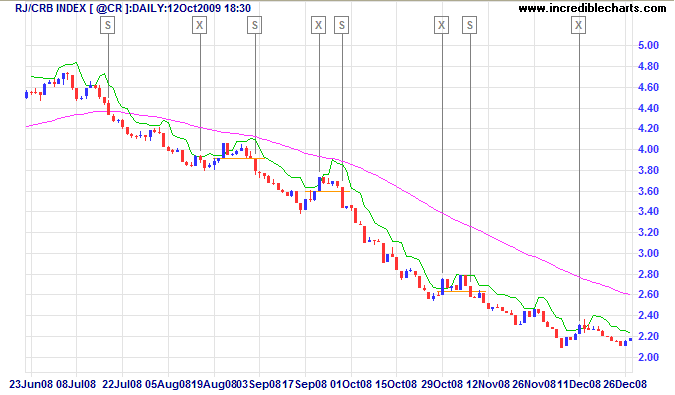

The RJ CRB Commodities Index late 2008 down-trend is displayed with Safezone (short, 22-day, multiple of 3) and 63-day exponential moving average used as a trend filter. Entries are taken when price makes a new 5-day low while below the moving average (or 5-day high when above the MA).

Mouse over chart captions to display trading signals.

- Go short [S] when price is below Safezone and closes below the 63-day exponential moving average

- Exit [X] when price crosses above the Safezone Line

- Go short [S] when price makes a new 5-day low while below the 63-day MA

- Exit [X] when price crosses above

- Go short [S] when price makes a new 5-day low while below the 63-day MA

- Exit [X] when price crosses above

- Go short [S] when price makes a new 5-day low while below the 63-day MA

- Exit [X] when price crosses above the Safezone Line

No long trades are entered while price is below the 63-day exponential moving average, nor short trades while above.

Setup

Default settings for Safezone are a 22-day period and a multiple of 2.5 times. Longer term traders may opt for wider multiples of 3.5 or 4.0.

See Indicator Panel for directions on how to set up an indicator — and Edit Indicator Settings to change the settings.

Safezone Formula

Define the Trend

First compare Closing Price to an exponential moving average to define the trend.

- If Closing Price is above the moving average for the selected period, that means that the trend (and the MA slope) is upward.

- If Closing Price is below the moving average, the trend is downward.

Directional Movement

The second element is Directional Movement. This is calculated in a similar fashion to DI+ and DI- in the Directional Movement System:

+DM = Today's High - Yesterday's High (when price moves upward)

-DM = Yesterday's Low - Today's Low (when price moves downward)

The difference is that you can have both +DM and -DM on the same day. If there is an outside day then both calculations will be positive. For an inside day both calculations are zero.

Directional Movement Days

Calculate the number of days with +DM in the selected period; and the number of -DM days. Elder uses the same selected period for Directional Movement as he does for the moving average, but there appears to be no reason why this could not be varied.

When the Trend is UP

Calculate -DM Average:

Sum of -DM for the period / Number of -DM days

Then calculate the Stop Level for today:

Today's Stop = Yesterday's Low - 2.5 * -DM Average

To delay/prevent the stop from being lowered, use the maximum of the last 3 days' stops.

When the Trend is DOWN

Calculate +DM Average:

Sum of +DM for the period / Number of +DM days

Then calculate the Stop Level for today:

Today's Stop = Yesterday's High + 2.5 * +DM Average

To delay/prevent the stop from being raised, take the minimum of the last 3 days' stops.

Note: We use a multiple of 2.5 in the above example, but any multiple between 2 and 4 is acceptable.

Evaluation

SafeZone has a number of strengths:

- Stops are less likely to move lower during an up-trend (or higher during a down-trend);

- SafeZone does not assume that the trend has changed every time that your stops are hit; and

- SafeZone uses Directional Movement rather than ATR as a measure of volatility. This is an excellent concept. It attempts to isolate counter- trend movement as the risk factor when following a trend and removes the other irrelevant component of volatility (movement in the direction of the prevailing trend). A runaway trend (or blow-off) may show little or no counter-trend movement, meaning that stops move tighter as the trend accelerates into a blow-off.

Potential weaknesses:

- SafeZone fails to adequately distinguish between counter-trend movement and movement in the direction of the prevailing trend — at the start of a trend or if the trend reverses within the selected time period. All -DM and + DM is treated equally, whether the trend is up or down, giving an incorrect reflection of counter-trend movement.

- The relatively short time period over which directional movement is calculated may not adequately reflect potential counter-trend movement.

- SafeZone relies on an exponential moving average to indicate trend direction, introducing some lag. There is nothing, however, to stop the trader from substituting another trend indicator in place of the moving average.

Overall, a clever system.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.