Ultimate Oscillator

Ultimate Oscillator is a momentum oscillator developed by Larry Williams in 1976. Short-term oscillators tend to signal oversold too early in the trend while longer time periods tend to give late entry signals, often when the rally has almost expired. The key feature of the Ultimate Oscillator is that it uses three time frames in order to minimize false signals. Larry Williams gives a detailed history of the oscillator and how to trade it on his website.

Trading Signals

Larry Williams has two requirements for a buy or sell signal from the Ultimate Oscillator:

- Divergence between the Ultimate Oscillator and Price; and

- The Ultimate Oscillator falls below the low between the two peaks, if Price is trending upwards, or above the peak between two troughs when Price is trending higher.

Williams adds one provision:

"All divergence signals must first have seen the index rise above 50% for sell and fallen below 30% for a buy. Divergent patterns that occur without the index first going to these levels are not to be acted upon."

Exits

Williams describes three types of exits:

When Short

- Reverse your position if you get an opposing signal;

- Exit but do not reverse your position if the Ultimate Oscillator falls below 30%*; and

- Exit if the Ultimate Oscillator rises above 65% at any time during a short trade.

When Long

- Reverse your position if you get an opposing signal;

- Exit but do not reverse your position if the Ultimate Oscillator rises above 70%; and

- Exit if the Ultimate Oscillator falls below 45%** at any time during a long trade after it has crossed above 50%.

* Williams comments that this signal may be early at times but will increase your percentage of winners.

** Interesting that 45% is not the mirror image of the rule for short positions. Williams seems less inclined to tolerate pull-backs in a long position than when going short.

Variation to Ultimate Oscillator Signals

I have introduced some variations to Larry Williams' signals for the Ultimate Oscillator. Sometimes good signals are missed because there is no divergence: price has already reversed direction or reverses at the same time as the Ultimate Oscillator. See [1] and [6] in the example below. I dispense with the requirement for Price to Diverge and simply look for reversals on the Ultimate Oscillator.

Also recovery above the intervening high (or below the intervening trough) can be unduly onerous if the first trough reaches below 30% (or high above 70%) as in [6] above. This rule can be amended to simply a cross above/below 50%.

Revised Signals

Revised requirements for a trade:

- The Ultimate Oscillator reverses direction, with a lower peak after rising above 70% or a higher trough after falling below 30%; and

- The Ultimate Oscillator then crosses back below 50% after the lower peak or above 50% after the higher trough*.

* You may encounter an extreme situation where the second peak is already below 50%, or the second trough is already above 50%, and therefore will not cross the 50% level. These are very strong signals and I would simply substitute reversal by 10% for the second requirement.

Ultimate Oscillator Example

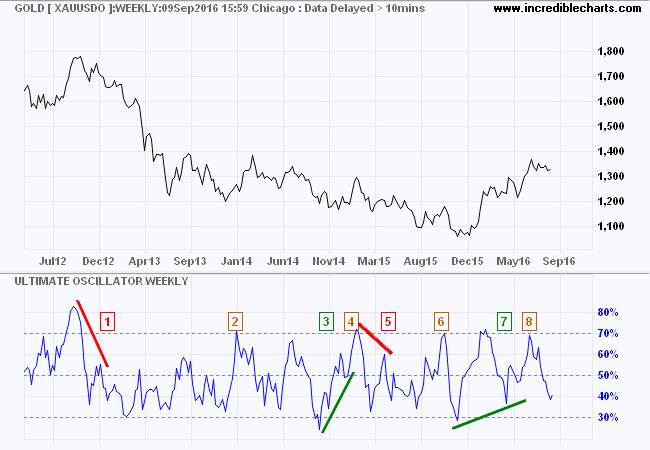

The weekly chart of Spot Gold is plotted with a 5,10,20-week Ultimate Oscillator for a long-term view.

- Lower peaks on the Ultimate Oscillator warn of a sell-off in late 2012. Go short when the oscillator reverses below 50% in late December 2012. [Note there is no divergence, as price reversed at the same time as the indicator, so this would not be a valid signal using Williams' original rules.]

- Ultimate Oscillator does not cross below 30% so exit when it rises above 65% in late 2013.

- Ultimate Oscillator crossed below 30% and shows a bullish divergence in November 2014. Go long when the Oscillator rises above 50%.

- Exit the long trade when Ultimate Oscillator rises above 70% in early 2015.

- A lower peak on Ultimate Oscillator warns of a potential short trade. Go short when the Oscillator falls below 50% in April 2015, after the lower peak. [Note Ultimate Oscillator does not cross below the intervening trough so this would not be a valid signal using Williams' original rules.]

- Exit the short trade when Ultimate Oscillator rises above 65% in October 2015.

- Rising peaks on the Ultimate Oscillator (after crossing below 30%) signal an up-trend. Go long in April 2016 when the Oscillator rises above 50% after the second trough. [Note there is no divergence, as price reversed at the same time as the indicator, so this would not be a valid signal using Williams' original rules. Ultimate Oscillator also does not rise above the intervening high at 70%.]

- The Ultimate Oscillator does not rise above 70%. Exit the long position in late August 2016 when the Oscillator retreats below 45%.

Ultimate Oscillator - Setup

The default setup is Larry William's 7, 14 and 28-day time periods. If you vary from the default, each of the time periods is double the preceding one. For example, if you select 15 days, the longer time periods will be 30 and 60 days. Likewise 5, 10 and 20 weeks.

Select Indicators and Ultimate Oscillator in the left column of the Indicator Panel. See Indicator Panel for directions on how to set up an indicator. To alter the default settings - Edit Indicator Settings.

Ultimate Oscillator Colors

Traditionally blue in color. To amend indicator colors, open the legend by clicking "L" on the toolbar or typing "L" on your keyboard. Adjust individual colors by clicking on the color patches next to the indicator in the legend.

Ultimate Oscillator Formula

First calculate Buying Activity: Close - True Range Low

Then True Range: True Range High - True Range Low

Sum Buying Activity for each of the three periods (e.g. 7, 14 and 28 days).

Sum True Range for each of the same periods.

Calculate Buying Percentage by dividing the Sum of Buying Activity by the Sum of True Range for each of the three periods.

Multiply Buying Percentage for the shortest period by 4, and the middle period by 2, so that all three periods have equal weight.

Ultimate Oscillator is calculated as the sum of equal-weighted Buying Percentage for each of the three periods, divided by 7 (4 + 2 + 1) and expressed as a percentage.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.