Money Flow Index

The Money Flow Index is a volume-weighted version of the Relative Strength Index, used to warn of trend weakness and likely reversal points. The indicator compares the value traded on up-days to value traded on down-days.

Trading Signals

Ranging Market

Ranging markets can be identified by Money Flow Index fluctuating close to the 50 level.

Trending Market

Market tops are likely when a medium term Money Flow Index is above 80.

Market bottoms are likely when a medium term Money Flow Index is below 20.

- Go long on bullish divergence.

- Go short on bearish divergence.

Only trade with the trend and exit using a trend indicator.

Example

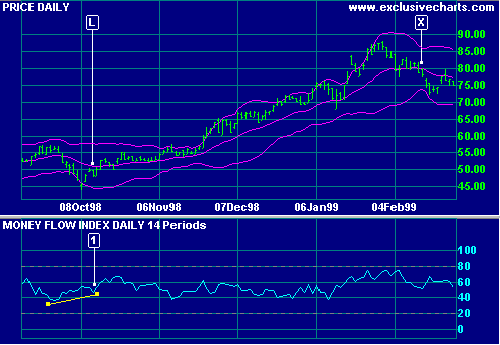

Microsoft Corporation plotted with Bollinger bands at 2.0 standard deviations around a 20 day exponential moving average and 20 day Money Flow Index.

Mouse over chart captions to display trading signals.

Exit using the moving average - this example uses MA direction as a filter. Compare this to the results if a single close or 2 closes are used as a filter.

- Go long [L] on a bullish divergence. Exit when the moving average turns down at [X].

Setup

The default Money Flow Index window is 14 days. Overbought/oversold are set at 80% and 20% levels. To alter the default settings - Edit Indicator Settings.

See Indicator Panel for directions on how to set up an indicator.

Formula

- Calculate Typical Price for each period:

(High + Low + Close) / 3 - Calculate Money Flow for each period:

Typical Price * Volume - Decide on the time

frame over which to calculate the index. This should be based on the

cycle that you are trading.

- Calculate Positive Money Flow:

Add Money Flow for each period (in the time frame) that Typical Price moves up. - Calculate Negative Money Flow:

Add Money Flow for each period (in the time frame) that Typical Price moves down. - Calculate the Money Ratio:

Positive Money Flow / Negative Money Flow - Calculate the Money Flow Index:

100 - 100 / (1+ Money Ratio)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.