Three Moving Averages

The Three Moving Average system attempts to identify ranging markets which are then avoided as they tend to be unprofitable when traded with trend indicators.

Trading Signals

The system features three moving averages: fast, middle and slow. Entry points are determined by the middle moving average crossing the long moving average and exit points by the fast moving average crossing the middle moving average:

Go long when:

- middle moving average crosses to above slow moving average from below; AND

- fast moving average is above middle moving average.

Close long when fast moving average crosses to below middle moving average from above.

Go short when:

- middle moving average crosses to below slow moving average from above; AND

- fast moving average is below middle moving average.

Close short when fast moving average crosses to above middle moving average from below.

Example

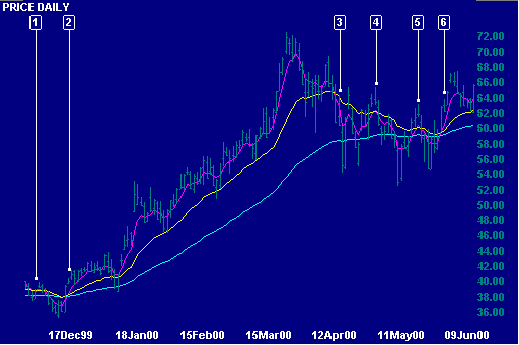

Intel Corporation chart with 5 day (fast), 21 day (middle), and 63 day (slow) exponential moving averages.

Mouse over chart captions to display trading signals.

- Close previous long trade as the fast moving average has fallen below the middle moving average.

- Go long as the middle moving average has risen above the slow moving average (and the fast moving average above the middle moving average).

- Close long trade - fast moving average has fallen below middle moving average.

- We are whipsawed in and out of a long position as the fast moving average crosses to above then back under the middle moving average.

- Another whipsaw.

- Go long as the fast moving average crosses to above the middle moving average (and the middle moving average is above the slow moving average).

Whipsaws are not entirely eliminated. Using trailing stops to time entry and exit points may further reduce unprofitable trades.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.