The Fed's Failed Monetary Policy

Ben Bernanke and I have little in common, but we share the view that any form of recovery is dependent on confidence. Recovery of consumer confidence would lead to an increase in consumer spending, especially on big ticket items like cars, homes and furniture. Business confidence is likewise a necessity to increase investment in new plant and equipment and new ventures that lift employment. Investor confidence is also needed for business to finance new investment at a reasonable cost. Uncertainty inhibits jobs growth.

Where we differ is in how to restore confidence. His view is that inflation is too low and that higher inflation would encourage creation of new jobs. And could be achieved by injecting further money into the system, through Treasury purchases. He recently observed: "Empirical evidence suggests that our previous program of securities purchases was successful in bringing down longer-term interest rates and thereby supporting the economic recovery." While asset purchases may have lowered longer-term interest rates, what does he mean by it supported the economic recovery? Did lower interest rates create new jobs? No. Did it spur new investment? No. Did it raise consumer confidence? No.

What has QE achieved so far?

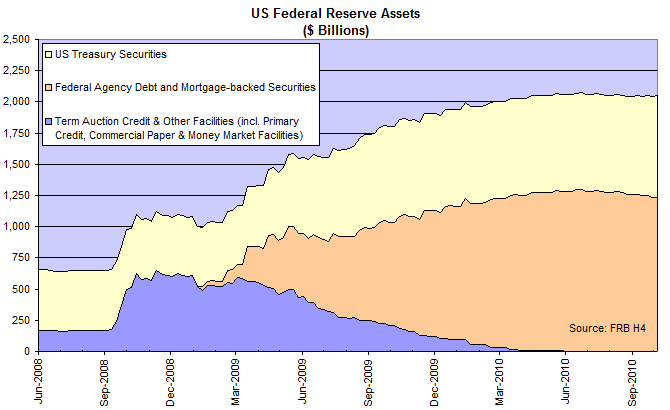

A quick look at the Fed's balance sheet shows that they injected $1.4 trillion into the financial system between September 2008 and March 2010.

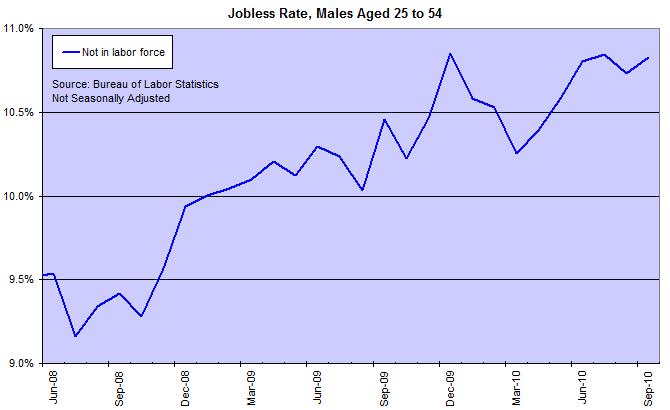

Lets see how well that worked. The jobless rate climbed instead of falling as projected.

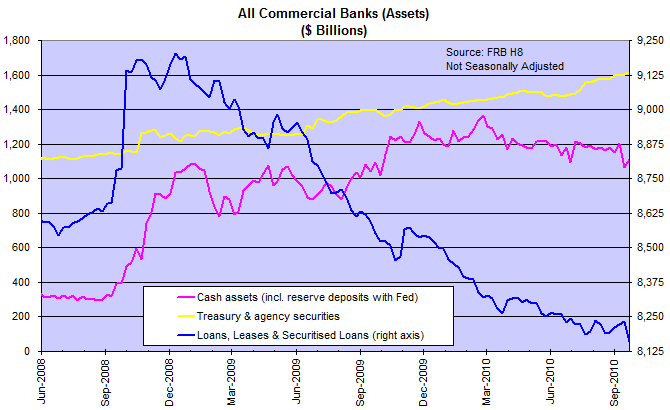

The reason for that lies with bank lending. Since the dramatic rise in bank assets in September 2008, following the collapse of the shadow banking system, loans and leases have steadily shrunk*, falling more than a trillion dollars. That clearly indicates there has been no up-turn in business investment.

*Securitized loans are included to eliminate any distortion when they were moved back onto bank balance sheets.

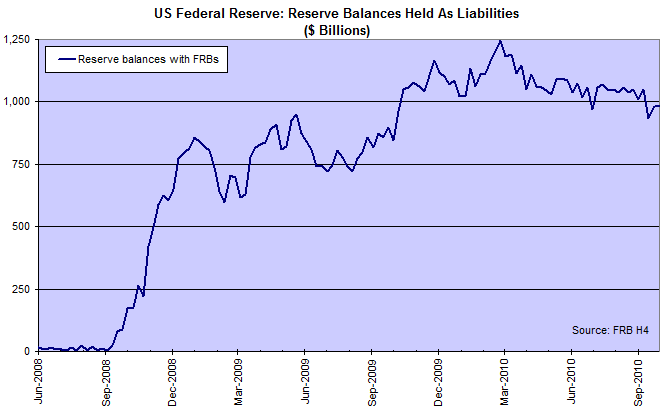

Monetary stimulus did not arrest the contraction of bank credit. So where did the money go? About $1 trillion was deposited back with the Fed as excess reserve deposits. And another half trillion was invested by banks in Treasury and Agency Securities. None of this flowed into new private investment.

The S-word

What the Fed does not seem to realize is that stimulus is not the answer. In their attempts to manipulate the economy for the last three decades, with all the finesse of a bull in a china shop, they have succeeded in fostering massive volatility which is now proving difficult to tame. Destroying conservative investment strategies and encouraging speculation on a massive scale.

The key to restoring confidence is stability. Businesses need a stable environment in which to invest with confidence. It is impossible for them to make accurate forecasts with unstable exchange rates, uncertain input costs, volatile inflation rates and worsening employment levels. Consumers also need a stable employment environment before they can take on additional financial commitments. And both need a stable interest rate environment so the rug is not pulled out from under their feet when they are committed. Investors also thrive in a stable, low inflation environment — where they can invest in financial assets without fear of their capital being termited by the Fed.

That may seem a tall order in the present environment, but what is needed is a long-term commitment to stability. Target a mid-range (equilibrium) interest rate and stick to it. Resist the temptation to juice up the economy when it is flat, so they will not be forced to slam on the brakes when it overheats.

View rapid debt growth as a threat, not an objective. A great deal has been written in recent years about real estate bubbles, stock market bubbles and even bond market bubbles. But there is really only one kind of bubble — that is a debt bubble. Without low interest rates fueling rapid debt growth any form of bubble would wither on the vine.

If you investigate individually the manias that the market has so dubbed over the years, in every case, it was expansive monetary policy that generated the boom in an asset. The particular asset varied from one boom to another. But the basic underlying propagator was too-easy monetary policy and too-low interest rates .....

~

Anna Schwartz co-author with Milton Friedman of A Monetary History of the United States (1963).

The more you foster stability, the more you will encourage private investment and business expansion. And the more you will generate permanent jobs — not the here-today-gone-tomorrow kind conjured up by government stimulus programs.

FOMC entrenched

The problem is that the Fed has been using the same monetary tools (open-market operations supervised by the FOMC) for so long that they have become entrenched in the system. They are not even prepared to acknowledge that their tools no longer work. If they blindly persist with them, we are headed for even greater disaster.

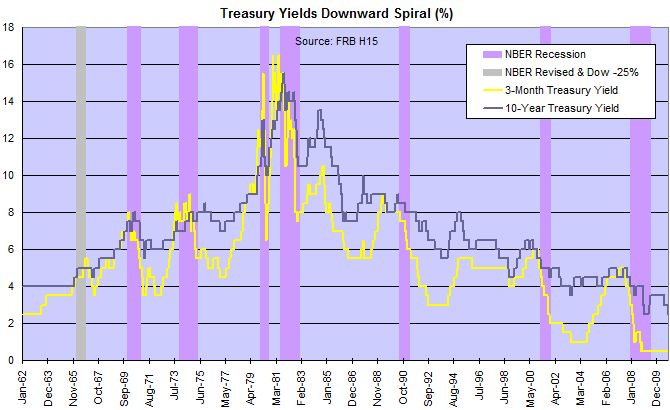

Having lowered interest rates to practically zero, bank lending continues to contract and the jobless rate is rising. The Fed is running out of room to maneuver, as we can see from the above chart of Treasury yields. Since the early 1980s, each successive trough required lower short-term interest rates to stimulate the economy. Now rates are close to zero and the economy is not responding. Rather than question the efficacy of their strategy, however, the chairman is now advocating that the Fed take action to lift the inflation rate — in a last ditch effort to induce further borrowing.

The nuclear option

How can the Fed lift the inflation rate if banks won't lend and businesses won't borrow? Their last available resort is the nuclear option, buying Treasurys directly from the government, rather than from private investors. In effect the Fed prints new money to fund the federal budget deficit. But creating another bubble to save us from the consequences of the last one is not a long-term solution. Inflation will further erode confidence and generate even greater instability. The path being followed by the Fed failed to work in Japan for the last two decades and is unlikely to work here.

The Great Depression was not some Act of God or the result of some deep-rooted contradictions of capitalism, but the direct result of a series of misjudgements by economic policy makers, some made back in the 1920s, others after the first crises set in — by any measure the most dramatic sequence of collective blunders ever made by financial officials. More than anything else, therefore, the Great Depression was caused by a failure of intellectual will, a lack of understanding about how the economy operated.

~ Lords of Finance by Liaquat Ahamed

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.