Volatility Ratio (Schwager)

This ratio is similar to one used by Jack Schwager in Technical Analysis to identify wide-ranging days.

Example

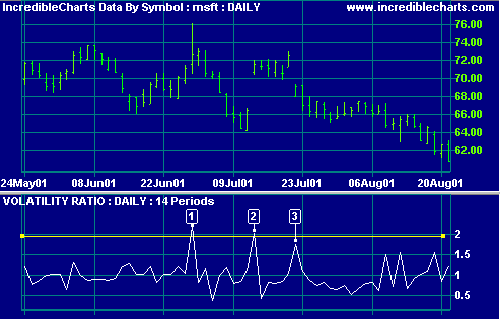

Microsoft Corporation with 14-day Volatility Ratio (VR).

Mouse over chart captions to display trading signals.

Wide ranging days are signaled by a Volatility Ratio greater than 2.0

- A wide-ranging day signals a likely reversal.

- Price gaps sharply upward.

- A downward gap signals the completion of an island cluster reversal, formed by [2] and [3].

Setup

The default period for Volatility Ratio is 14 days. To alter the default settings - Edit Indicator Settings.

See Indicator Panel for directions on how to set up the indicator.

Formula

Volatility Ratio = True Range / EMA of True Range for the past n periods

EMA = exponential moving average

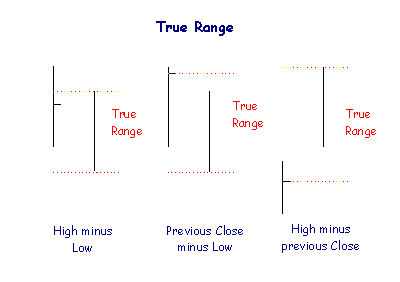

True Range is the greater of:

- The day's High minus the Low;

- Today's High minus yesterday's Close; and

- Yesterday's Close minus today's Low.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.