Stock Screener: Twiggs® Momentum

Twiggs Momentum is particularly useful in identifying well-established trends. In this screen I use 50-Week Twiggs Momentum to identify long-term trends with the potential to last several years.

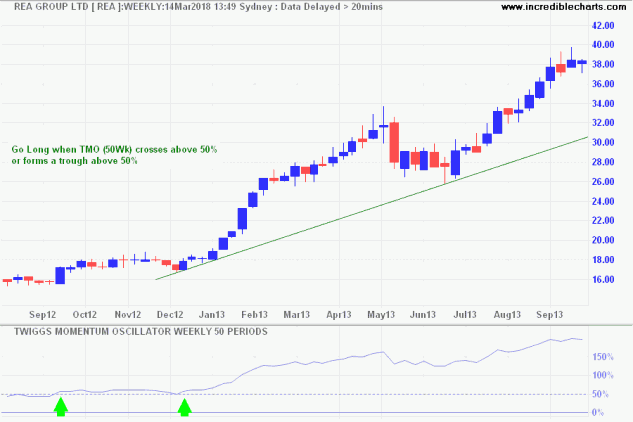

Signals are taken when 50-Week Twiggs Momentum rises above 50% or when Momentum forms a trough above the 50% line. In the example below, ASX stock REA Group (REA) signals commencement of a strong trend at the two green arrows.

- Twiggs Momentum rises above 50%, signaling the start of the trend.

- A second entry point is signaled when Twiggs Momentum forms a trough above 50%.

Screening for Twiggs® Momentum

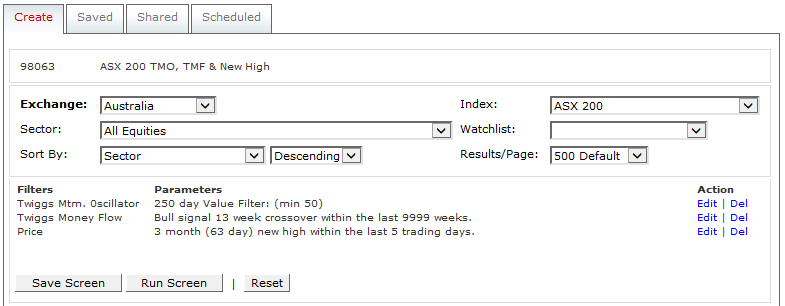

I created a stock screen to help identify trending stocks above 50% on 250-Day Twiggs Momentum.

The scan combines three filters for the ASX 200:

- 250-Day Twiggs Momentum above 50%;

- 13-Week Twiggs Money Flow above zero; and

- A 63-Day New High formed in the last 5 trading days.

The idea is to capture stocks with strong momentum that also signal buying pressure (Twiggs Money Flow above zero) and have recently commenced a new rally, forming a medium-term New High.

Try the scan and let me know whether you find it useful.

The scan is available as Shared Screen #98063:

- Select

on the toolbar

on the toolbar - Select the Shared tab

- Search for ScreenID 98063

Select View if you want to amend the Exchange or Index (e.g. to US Stocks and S&P 500).

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.