Stock Screener: Twiggs® Money Flow Trends

Twiggs Money Flow has proved invaluable in identifying buying pressure for a stock; often before price has even begun to trend.

Troughs above the zero line signal strong accumulation, while peaks below zero warn of distribution. In the example below, ASX stock Altium Ltd (ALU) signals strong buying pressure at the two green arrows, when ALU completed a trough above zero. A trough is considered complete when Twiggs Money Flow rises for at least 2 weeks.

Screening for Twiggs® Money Flow

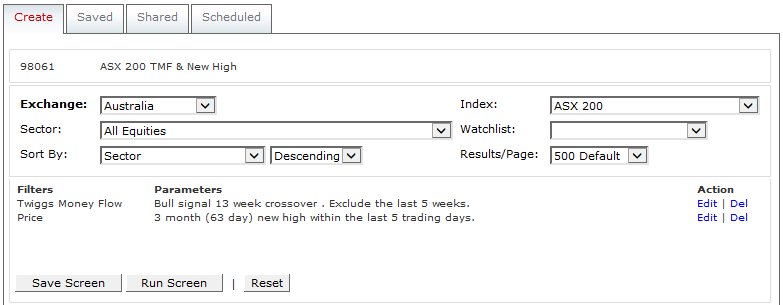

I created a stock screen to identify stocks that are likely to be forming troughs above zero.

The scan combines two filters for the ASX 200:

- 13-Week Twiggs Money Flow above zero for more than 5 weeks; and

- An equivalent period (63-Day) New High formed in the last 5 trading days.

The idea is to capture stocks that signal buying pressure (Twiggs Money Flow above zero) and that have recently formed a medium-term New High, commencing a potential breakout.

Try the scan and let me know whether you find it useful.

The scan is available as Shared Screen #98061:

- Select

on the toolbar

on the toolbar - Select the Shared tab

- Search for ScreenID 98061

Select View if you want to amend the Exchange or Index (e.g. to US Stocks and S&P 500).

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.