Screen for Mark Minervini's Trend Template

I received a request from a reader, Graham, to set up a screen for stocks that fit Mark Minervini's Trend Template from his book Trade Like A Stock Market Wizard. While the title is off-putting, the book is well worth a read, with plenty of good advice on how to combine fundamental and technical analysis.

The Trend Template combines 50-, 150-, and 200-day moving averages to identify trend direction, and position of closing price relative to the 52-week High and 52-week Low to highlight current potential.

While not an exact fit, I am pleased with the results from the two screens created:

- Minervini USA Trend Template - ID 102151

- Minervini ASX Trend Template - ID 102152

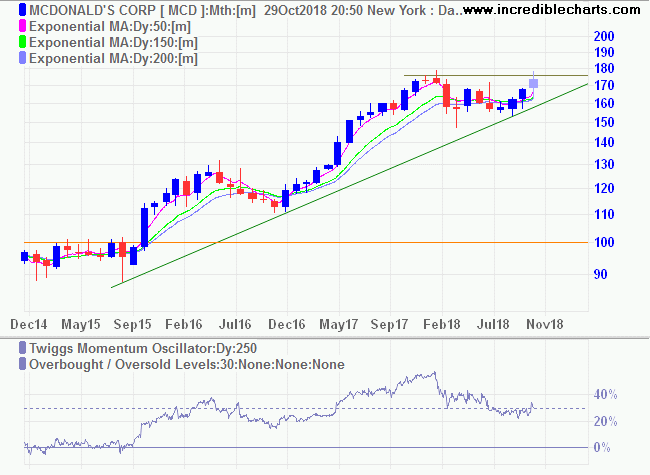

McDonald's Corp (MCD) was highlighted by the first screen. Since its breakout above $100 after a three-year consolidation MCD shows a strong up-trend. Currently testing resistance at $175, breakout would signal another primary advance.

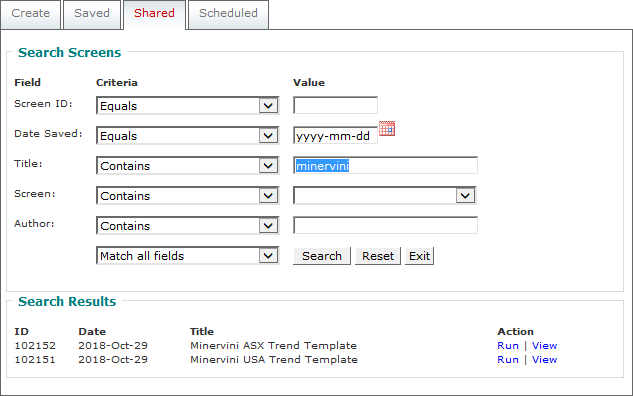

You will find the new screens by clicking the Shared tab on the Stock Screener. Navigate from Securities >> Stock Screener on Incredible Charts menu bar.

Enter the screen ID (e.g. 102151) or the title "Minervini" and click Search.

I restricted the screen to the Russell 1000 (USA) and ASX 300 to eliminate penny stocks but you can modify the screens to suit your own requirements. Select View, modify the screen if required and Save Screen to store on your PC.

Hope you find them useful.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.