Stock Screener: Breakouts From A Base

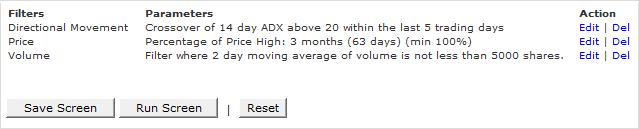

Filters

To find stocks that are breaking out from a long-term base, we need to screen for stocks that have started to trend and are making hew highs. Use the following filters.

Directional Movement: ADX Crossover

ADX crossing above 20 signals a stock that has started to trend.

Percentage Of Price High

Identify stocks making new highs by screening for 100% Minimum Percentage Of Price High.

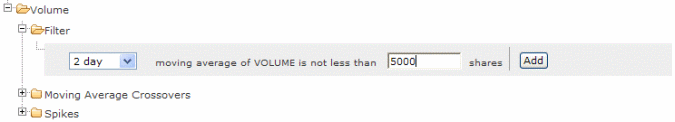

Volume Filter

Add a Volume Filter to eliminate illiquid or dormant stocks.

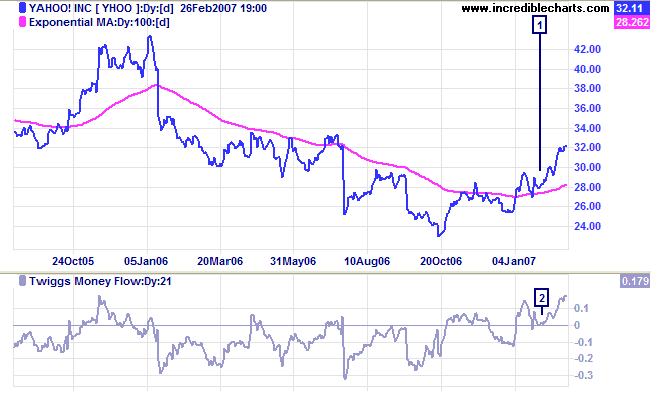

Example

Yahoo [YHOO] turned up in a screen of the S&P 500 for stocks with 12 Month Price Move less than zero and Closing Price above the 100-Day EMA.

Mouse over chart captions to display trading signals.

- Enter when price respects the 100-day MA (not on the first cross-over).

- Look for confirmation from Twiggs Money Flow respecting zero -- signaling accumulation.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.