Screening for Relative Strength Index (RSI)

Relative Strength Index

The Relative Strength Index is calculated using the Wilder moving average formula.

Signals

- Bull Signal

When the RSI crosses from below to above the oversold level. - Bear signal

When the RSI crosses from above to below the overbought level.

Oversold levels may be set at either 20% or 30% and overbought levels at 70% or 80%.

To Set the RSI Crossover:

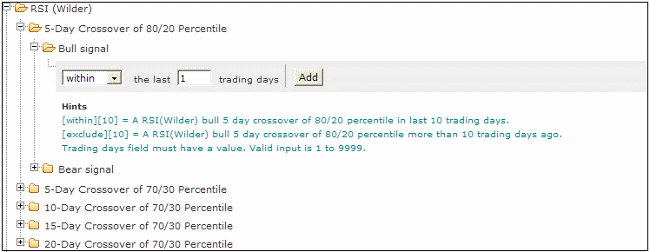

- Select the Relative Strength Index filter

- Then select a Crossover filter

- Choose either the Bull signal or Bear signal

- Select the number of days within which the crossover must have occurred or excluded

- Click on the Add button to add the filter.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.