Stock Screener - Schedule Screen

Regular stock screens can be scheduled on a daily, weekly, monthly or quarterly basis. Active traders will find daily emails particularly useful, but weekly emails are recommended for longer-term traders.

To schedule a saved screen:

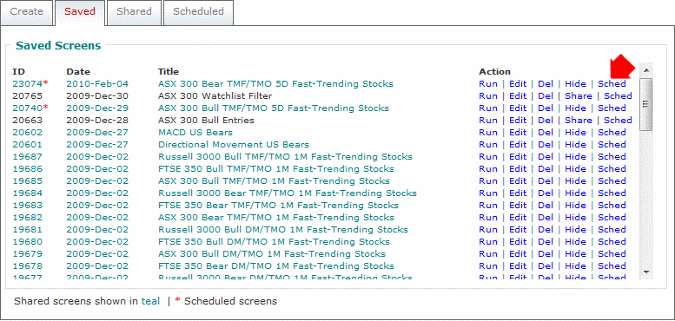

- Open the stock screener

- Open the Saved tab to view your saved stock screens

- Click the Sched link next to a saved screen

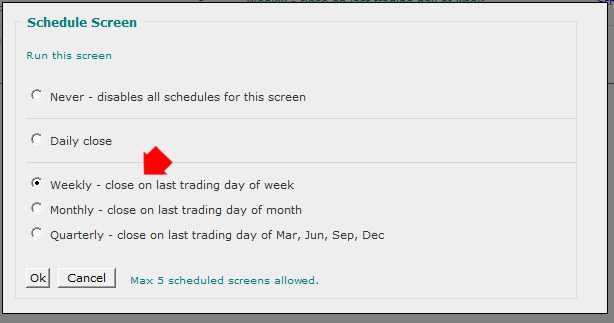

- Select how often the screen must run: Never, Daily, Weekly, Monthly or Quarterly

- If daily screens are chosen, select which day/s of the week it is to be emailed

The emailed link will open the screen results in your browser, identifying new additions and stocks carried over from the last screen. The results can also be downloaded to a spreadsheet.

Edit Schedule Frequency

To revise the screens frequency go to the Scheduled tab in the Stock Screener, and select the Sched link next to a Scheduled Screen.

Delete Scheduled Screen

To delete a scheduled screen go to the Scheduled tab in the Stock Screener, and select the Del link next to a Scheduled Screen. Alternatively Edit the schedule to Never.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.