Two Moving Averages

An alternative approach to using filters is to use a fast moving average to represent the price line. The fast moving average used is normally 5 days and the slow moving average is selected according to the length of the cycle being traded.

The system still has the same weakness as the single moving average system: unprofitable trades are signaled during ranging markets.

Trading Signals

Signals are generated when the moving averages cross:

- Go long when the fast moving average crosses the slow moving average from below.

- Go short (reverse your position) when the fast moving average crosses the slow moving average from above.

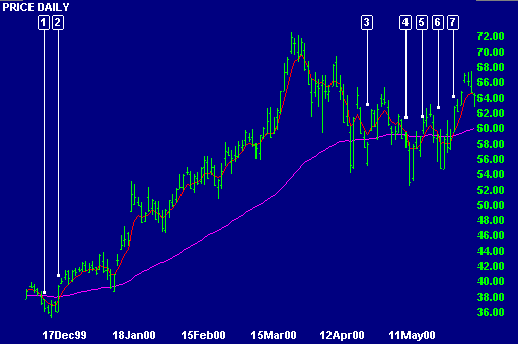

You can always identify the fast moving average by its higher peaks and troughs. Take a look at the chart below.

Example

Intel Corporation is plotted with 5 day and 63 day exponential moving averages.

Mouse over chart captions to display trading signals.

- Go short when the fast moving average crosses to below the slow moving average.

- Go long when the fast moving average crosses to above the slow moving average.

- No action is taken as the MA's have not crossed.

- Go short.

- Go long.

- Go short.

- Go long.

The system reduces whipsaws but still signals losing trades during a ranging market. Trailing Stops may help to eliminate unprofitable trades.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.