Moving Average Filters

Moving averages are prone to whipsaws, when price crosses back and forth across the moving average in a ranging market. Traders have developed a number of filters over the years to eliminate false signals.

Moving Average Trading Signals

The simplest moving average system generates signals when price crosses the moving average:

- Go long when price crosses to above the moving average from below.

- Go short when price crosses to below the moving average from above.

Filters

Filters are added to objectively measure when price has crossed the moving average. The most common filters are:

- Closing Price - either one, two or three successive days must all close above/below the moving average

- The entire bar must cross the moving average

- Two or three bars (in succession) must all be clear of the moving average

- The moving average must slope in the direction of the trade

- Typical price, Median price or Weighted close can also be used as substitutes for closing price.

Moving Average Slope

Trades are only entered if the moving average slopes in the direction of the trade. This filter will not work with exponential moving averages because the exponential moving average always slopes up when price closes above the moving average and slopes down if it closes below.

- Go long if price crosses a rising moving average from below.

- Go short if price crosses a falling moving average from above.

Exit when price re-crosses the moving average.

Moving Average Slope can be used in conjunction with other filters such as closing price.

Example

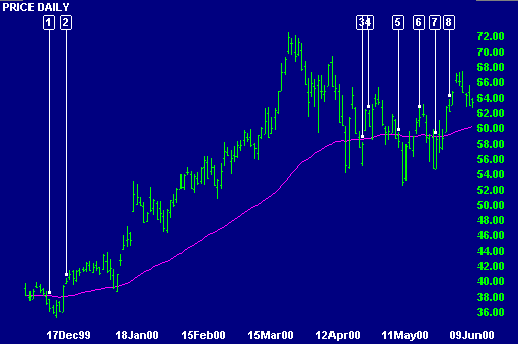

Intel Corporation is plotted with a 63 day exponential moving average.

The single moving average is used with two filters:

- Moving average direction, and

- The moving average must be crossed by closing price on two consecutive days.

Mouse over chart captions to display trading signals.

- Go short - two closes below a falling moving average.

- Go long - moving average is now rising

and price has closed above the moving average

for 2 days.

The following dip below the moving average (in early January) is filtered out. - The long trade is exited as there are two closes below the

moving average.

No short trade is entered as the moving average is sloping upwards. - Go long - two closes above a rising moving average.

- Go short as there are two closes below a falling moving average.

- Go long - two closes above a rising moving average.

- Go short - two closes below a falling moving average.

- Go long - moving average is rising again and there are 2 closes above it.

Note how profitable the long trade [2] is during the strong upward trend, compared to when price whipsaws around the relatively flat moving average, frequently switching you in and out of trades. Trend indicators are normally unprofitable, and should be avoided, during ranging markets.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.