Rainbow 3D Moving Averages

Rainbow 3D Moving Averages were developed by Ivan Ballin (Forum Profile: Ingot54)) as a variation of the Multiple Moving Averages of Daryl Guppy. Exponential moving averages ranging from 2 weeks to 200 weeks are plotted on the price chart using the full color spectrum. The indicator is very useful in highlighting trend changes -- when your eyes have adjusted to the array of colors.

Trading Signals

Signals are similar to Multiple Moving Averages:

Convergence and Divergence

The most important signals are taken from the spacing between the Exponential Moving Averages (EMAs) in each group; not from crossovers.

- When moving averages within a group are parallel and close together, the group are largely in agreement;

- When the moving averages widen, this signals divergent views within the group;

- When moving averages converge, this is a sign that the group view is changing.

Trend Strength

- Parallel long-term EMAs signal long-term investor support and a strong trend; and

- Short-term MAs tend to bounce off the long-term MA group.

Trend Weakness

- Both groups of EMAs converge and fluctuate more than usual.

Trend Start

- A change in price direction accompanied by expanding EMAs in both groups.

Short-Term Reversals

- The short-term group cross over, diverge and then again converge; while the long-term group remain parallel.

Example

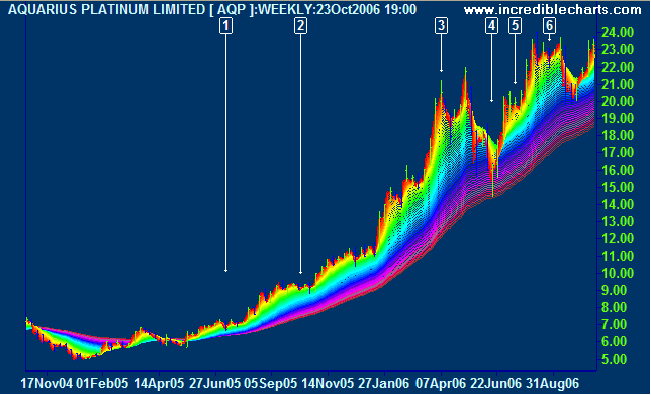

Aquarius Platinum Limited (AQP) is shown with Rainbow 3D Moving Averages.

Mouse over chart captions to display trading signals.

- Short-term retracement gives an entry signal (long)

- Another short-term retracement

- Moving averages diverge, increasing risk of a reversal

- Strong retracement indicates changing short and medium term views, but long-term view holds firm

- Short-term retracement signals recovery

- Moving averages diverge, warning of another reversal

Setup

Select Rainbow 3D Moving Averages in the left column of the Indicator Panel. Adjust the settings as required and save using the [>>] button. The default is Weekly moving averages.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.