Volatility Stops

Most traders adjust their stops over time in the direction of the trend in order to lock in profits. Apart from moving averages, one of the most popular techniques is trailing stops using a multiple of Average True Range. There are several variations:

- The original Volatility Stops, introduced by Welles Wilder in his 1978 book: New Concepts in Technical Trading Systems

- Chandelier exits introduced by Alexander Elder in Come Into My Trading Room (2002) trail the stops from Highs or Lows rather than Closing Price

- Average True Range Trailing Stops are similar to the above, but include a ratchet mechanism to prevent stops moving down during an up-trend or rising during a down-trend, as ATR increases

- Keltner Channels from Chester Keltner in How to Make Money in Commodities (1960) trails stops from a moving average instead of from Closing Price.

Volatility Stops Trading Signals

Signals are used for exits:

- Exit your long position (sell) when price crosses below the Volatility Stop.

- Exit your short position (buy) when price crosses above the Volatility Stop.

While not conventional, they can also be used to signal entries — in conjunction with a trend filter.

Example

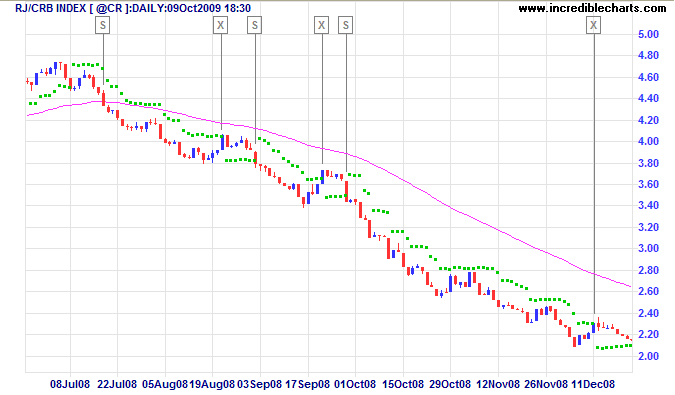

The RJ CRB Commodities Index late 2008 down-trend is displayed with Volatility Stop (3 x 21-day ATR) and 63-day exponential moving average used as a trend filter.

Mouse over chart captions to display trading signals.

- Go short [S] when price is below the Volatility Stop and closes below the 63-day exponential moving average

- Exit [X] when price crosses above the Volatility Stop

- Go short [S] when price crosses below the Volatility Stop

- Exit [X] when price crosses above

- Go short [S] when price crosses below

- Exit [X] when price crosses above the Volatility Stop

No long trades are entered while price is below the 63-day exponential moving average, nor short trades while above.

Setup

Welles Wilder used 7-day Average True Range and a multiple of 3. We have set the default, however, to a smoother 21-day Average True Range but retain the multiple of 3.

See Indicator Panel for directions on how to set up an indicator — and Edit Indicator Settings to change the settings.

Volatility Stops Formula

Welles Wilder's system uses Closing Price and incorporates a stop-and-reverse feature (as with his Parabolic SAR).

- Determine the initial trend direction

- Calculate the Significant Close ("SIC"): the highest close reached in an up-trend or the lowest close in a down-trend

- Calculate Average True Range ("ATR") for the selected period (7 days in this example)

- Multiply ATR by the Multiple (3.0 in this example)

- The first stop is calculated in day 7 and plotted for day 8

- If an up-trend, the first stop is SIC - 3 * ATR, otherwise SIC + 3 * ATR for a down-trend

- Repeat each day until price closes below the stop (or above in a down-trend)

- Set SIC equal to the latest Close, reverse the trend and continue.

Volatility Stops Evaluation

Using Closing Price rather than highs in an up-trend (or lows in a down-trend) may reduce the volatility of the system and could produce better results but there are two apparent weaknesses:

- Stops may move lower during an up-trend if Average True Range widens; and

- SAR assumes that the trend has changed every time that your stop is hit. Most traders will find that there stops are regularly hit without the trend changing — price merely retraces through your stops and then resumes the up-trend, leaving you lagging behind.

Average True Range Trailing Stops addresses the first weakness, Chandelier exits caters for the second, while Average True Range Bands addresses both.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.