Volume Oscillator

The Volume Oscillator (VO) identifies trends in volume using a two moving average system.

The Volume Oscillator measures the difference between a faster and slower moving average (MA).

- If the fast MA is above the slow MA the oscillator will be positive.

- If the fast MA is below the slow MA then the oscillator will be negative.

- The Volume Oscillator will be zero when the two MA's cross.

Trading Signals

- Rising volume (positive VO) signals a strong trend.

- Falling volume (negative VO) indicates trend weakness.

Example

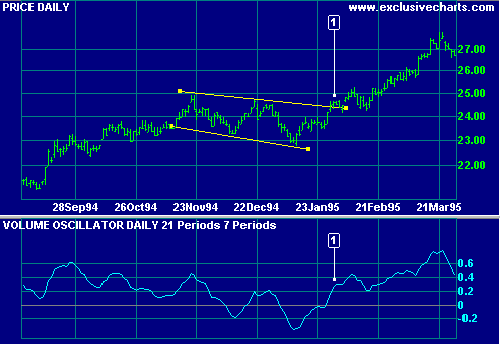

Coca Cola Corporation with Volume Oscillator.

Mouse over chart captions to display trading signals.

Price forms a flag pattern after a strong up-trend. Volume declines on each trough and rises on each peak, suggesting an upward breakout.

- The breakout above the resistance line is then confirmed by a sharp rise in volume.

Setup

See Indicator Panel for directions. The default Volume Oscillator settings are:

- Fast MA - 5 days

- Slow MA - 10 days

- Exponential moving averages.

To alter the default settings - Edit Indicator Settings.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.