Weighted Close

Weighted Close is similar to Typical Price - the only difference being that the weighted close, as the name implies, place greater weighting on closing price. Both indicators approximate the average price traded for a period and are used as filters in moving average systems.

Weighted Close is calculated as: (High + Low + Close * 2 ) / 4

Weighted Close is featured in Steven Achelis' book, Technical Analysis A-Z.

Example

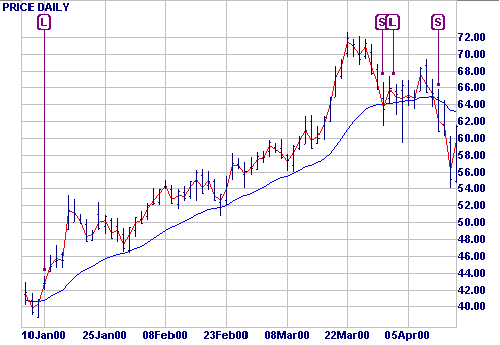

Intel shown with Weighted Close and 21 day exponential moving average.

Mouse over chart captions to display trading signals.

Using the Single Moving Average System:

Long signals [L] are generated when the weighted close crosses to above the moving average.

Short signals [S] occur when the weighted close crosses to below the moving average.

Observe how the weighted close filter eliminates a number of whipsaws (where price crosses the re-crosses the moving average).

Setup

See Indicator Panel for directions on how to set up an indicator.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.