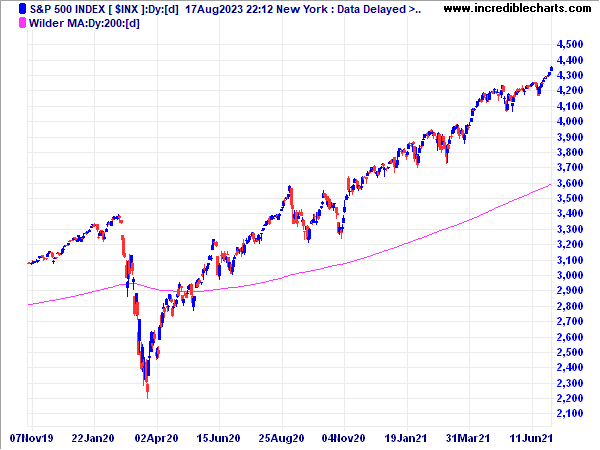

Wilder Moving Average

A number of popular indicators, including Relative Strength Index (RSI), Average True Range (ATR) and Directional Movement were developed by J. Welles Wilder and introduced in his 1978 book: New Concepts in Technical Trading Systems. Users should beware that Wilder does not use the standard exponential moving average formula. This can have significant impact when selecting suitable time periods for his indicators.

Welles Wilder's Moving Average Formula

The standard exponential moving average formula converts the time period to a fraction using the formula EMA% = 2/(n + 1) where n is the number of days. For example, the EMA% for 14 days is 2/(14 days +1) = 13.3%. Wilder, however, uses an EMA% of 1/14 which equals 7.1%. This equates to a 27-day exponential moving average using the standard formula.

Welles Wilder's Indicators

Indicators affected are:

- Average True Range;

- Directional Movement System;

- Relative Strength Index; and

- Twiggs Money Flow — developed by Colin Twiggs using Wilder's moving average formula.

Indicator Time Frames

We recommend that users try shorter time periods when using one of the above

indicators. For example, if you are tracking a 30-day cycle you would normally

select a 15-day Indicator Time Period.

With the RSI, adjust the time period as follows:

RSI time period = (n + 1) / 2 = (15 + 1) / 2 = 8 days

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.