Williams Accumulation Distribution

Williams Accumulation Distribution is traded on divergences. When price makes a new high and the indicator fails to exceed its previous high, distribution is taking place. When price makes a new low and the WAD fails to make a new low, accumulation is occurring.

Williams Accumulation Distribution was created by Larry Williams.

Trading Signals

- Go long when there is a bullish divergence between Williams Accumulation Distribution and price.

- Go short on a bearish divergence.

Example

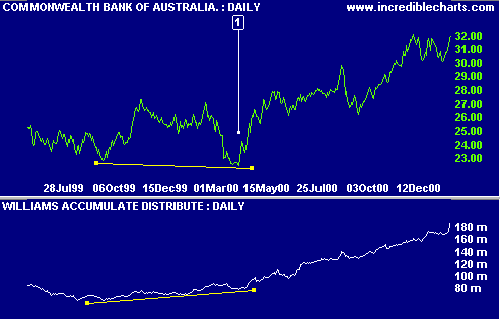

Commonwealth Bank of Australia (CBA) is plotted with Williams Accumulation Distribution.

Mouse over chart captions to display trading signals.

- Go long [L] on a bullish divergence.

Setup

See Indicator Panel for directions on how to set up an indicator. Edit Indicator Settings to alter the default settings.

Formula

To calculate Williams Accumulation Distribution:

1. Calculate the True Range High and True Range Low:

True Range High is the greater of:

- High [today], and

- Closing price [yesterday]

True Range Low is the lesser of:

- Low [today]

- Closing price [yesterday]

2. Compare Closing price to yesterday's Closing price:

- If Close [today] is greater than Close [yesterday]

Price Move [today] = Close [today] - True Range Low - If Close [today] is less than Close [yesterday]

Price Move [today] = Close [today] - True Range High - If Close [today] equals Close [yesterday]

Price Move [today] = zero

3. Multiply the price move by volume:

AD [today] = Price Move [today] * Volume [today]

4. Calculate the cumulative total:

Williams AD = AD [today] + Williams AD [yesterday]

AUTHOR'S NOTE:

Steven Achelis omits step 3. above in his book Technical Analysis A-Z and several other websites/software programs appear to follow this approach. For the benefit of investors accustomed to Achelis' approach, we have provided both versions. Achelis' version is described as Williams Accumulate Distribute.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.