Stock Screener

Moving Average Crossovers

- Crossovers are calculated using exponential moving averages (EMA).

- See Two Moving Averages for further details.

- Returns the number of days since the crossover occurred.

Signals

- Bull Signal

When the fast moving average crosses to above the slow moving average. - Bear Signal

When the fast moving average crosses to below the slow moving average.

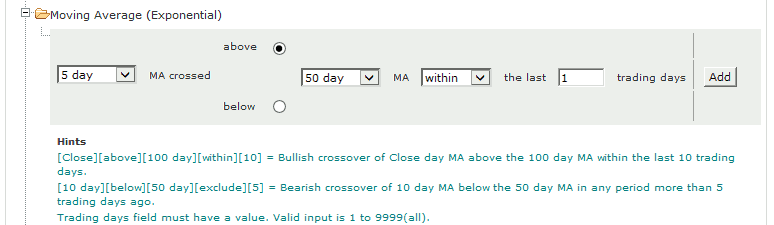

Example 1: Trend Reversal

Filter for 5-day EMA crossing above the 50-day EMA within the last 1 trading days.

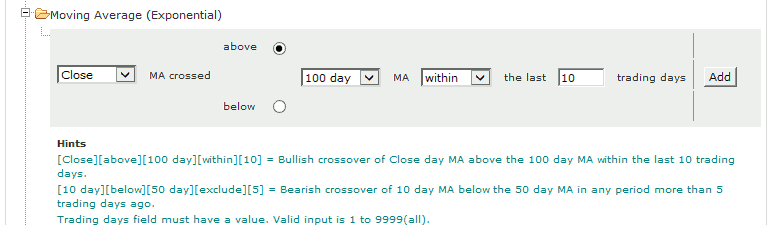

Example 2: Bullish Crossover

Filter for closing price crossing above the 100-day EMA within the last 10 trading days.

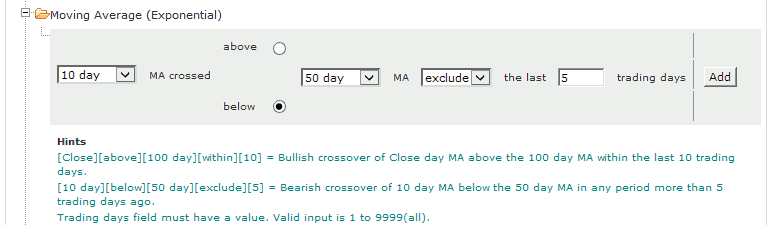

Example 3: Bearish Crossover

Filter for 10-day EMA crossing below the 50-day EMA before the last 5 trading days.

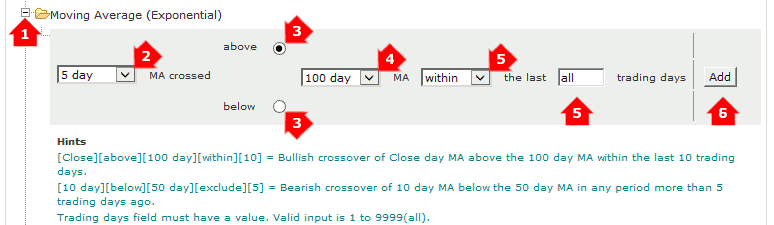

To Set the Moving Average Crossover:

- Open the Moving Average (Exponential) filter

- Use the drop-down to select the first moving average or "Close" if you want to identify closing price crossovers

- Choose above (Bull signal) or below (Bear signal)

- Select a second moving average or "Close"

- Select the number of days within which the crossover must have occurred or excluded

- Click Add to add the filter.

Example 4: Long-term up-trend

Filter for 5-day EMA crossing above the 100-day EMA within the last 9999 (all) trading days.

To screen for stocks that are in a long-term up-trend:

- Open the Moving Average (Exponential) filter

- Set a faster moving average (e.g. 5-day) as the first moving average

- Select above (Bull signal)

- Set a slower moving average (e.g. 100-day) as the second moving average

- Enter within all (or 9999) trading days

- Add the filter to your screen

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.