Trend Indicators

Trend indicators provide an objective measure of the direction of the trend. They are particularly useful when screening for stock breakouts or established trends.

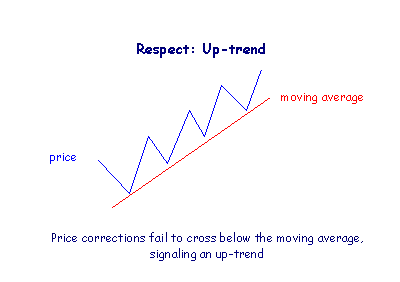

Traders often mistake corrections for a trend reversal, exiting a trend too early. At other times, they may hold on too long, giving back profits. Using trend indicators helps to eliminate indecision, saving time and easing psychological pressure.

Trending v. Ranging Markets

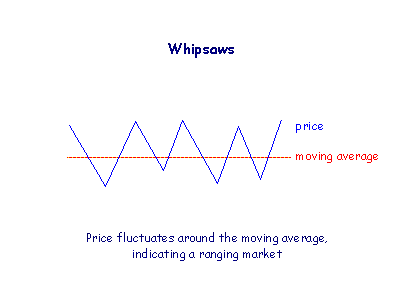

It is often difficult to separate the trend from surrounding 'noise' during the early stages. Most trend indicators lose money during a ranging market as fluctuations in a narrow price band tend to whipsaw traders in and out of their positions.

It is important to identify whether the market is trending or ranging and to employ indicators suited to the purpose: trend indicators for trending markets and faster momentum oscillators for ranging markets.

Types of Trend Indicators

Moving Average Systems

Moving averages smooth price data, representing the trend with a single line. While this offers the advantage of simplifying the trend, the smoothing process introduces a lag. That is why they are often called trend following indicators.

Signals can be taken from closing price fluctuating around a single moving average, otherwise from the interaction between two or more moving averages. The latter are used to minimize whipsaws but tend to introduce additional lag.

- Moving average

- Two Moving Averages

- Three Moving Averages

- Multiple Moving Averages (MMA)

- Rainbow 3D Moving Averages

Moving Average Oscillator

Moving average oscillator such as MACD are derived from two- or three-moving average systems above.

Trend Channels

Trend channels provide entry and exit signals when price crosses above or below the trend channel. Just be careful of taking entries at the top channel and exits at the bottom channel. Whipswas are likely to be expensive, although this system was successfully used with Donchian Channels by the legendary Turtle Traders.

Ichimoku Cloud

This is a complex system of leading and lagging indicators that deserves its own section.

Directional Movement and Momentum Oscillators

Long-term momentum oscillators can also be used to signal entry and exit points for trends. Momentum is a short burst of movement, while a trend is simply a sustained burst of momentum.

Stop and Reverse Systems

Trailing stop loss sytems like Parabolic SAR, in longer time frames, also provide trend entry and exit signals.

Closing price compared to Moving Average

Closing price systems minimize lag but may be more prone to whipsaws. They will also provide more responsive entry signals — after a ranging market — than exit signals when the moving average is rising.

Linear Regression

Linear regression can be used in a similar fashion to moving averages but tends to hold the prevailing trend for longer, providing earlier exit signals if the market starts ranging.

Trading Systems

Why not try our trend trading systems?

Evaluation

We prefer simple trend-following systems rather than more complex systems that may be too derived.

Price respecting the moving average is one of our favorite entry signals in an up-trend.

We also find stock screens with long-term momentum indicators such as Directional Movement or RSI particularly useful for identifying trend breakouts.

Exits are always the most difficult. Moving averages are prone to whipsaw or, alternatively, introduce considerable lag. Tight stops don't work: you have to give the trend room to breathe. Our suggestion is to use trailng stop losses such as Average True Range or Percentage Trailing Stops.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.